Three Things Patriotic Americans Should Know About The Government Shut-down

1. Conservative Money from radical anti-American conservative groups is behind the shut-down. There is no blame to spread around, conservative Republicans are completely responsible for the shut-down and any consequences suffered by any American from park visitors to families of veterans killed in action, The Money Behind the Shutdown Crisis

Representative Aaron Schock is a conservative Republican from Illinois, but not conservative enough for the hard-right activist group Club for Growth, which is seeking someone to run against him in next year’s primary.

His crime? In 2011, he voted to increase the debt ceiling, and, in 2012, he voted for a stopgap spending bill that prevented a government shutdown. In neither case did he demand the defunding of health care reform.

Club for Growth and other extremist groups consider a record like his an unforgivable failure, and they are raising and spending millions to make sure that no Republicans will take similar positions in the next few weeks when the fiscal year ends and the debt limit expires.

If you’re wondering why so many House Republicans seem to believe they can force President Obama to accept a “defunding” of the health care reform law by threatening a government shutdown or a default, it’s because these groups have promised to inflict political pain on any Republican official who doesn’t go along.

Heritage Action and the Senate Conservatives Fund have each released scorecards showing which lawmakers have pledged to “defund Obamacare.”

2. Conservative Republicans have been planning the shut-down for months,

Shortly after President Obama started his second term, a loose-knit coalition of conservative activists led by former Attorney General Edwin Meese III gathered in the capital to plot strategy. Their push to repeal Mr. Obama’s health care law was going nowhere, and they desperately needed a new plan.

Out of that session, held one morning in a location the members insist on keeping secret, came a little-noticed “blueprint to defunding Obamacare,” signed by Mr. Meese and leaders of more than three dozen conservative groups.

It articulated a take-no-prisoners legislative strategy that had long percolated in conservative circles: that Republicans could derail the health care overhaul if conservative lawmakers were willing to push fellow Republicans — including their cautious leaders — into cutting off financing for the entire federal government.

“We felt very strongly at the start of this year that the House needed to use the power of the purse,” said one coalition member, Michael A. Needham, who runs Heritage Action for America, the political arm of the Heritage Foundation. “At least at Heritage Action, we felt very strongly from the start that this was a fight that we were going to pick.”

Last week the country witnessed the fallout from that strategy: a standoff that has shuttered much of the federal bureaucracy and unsettled the nation.

To many Americans, the shutdown came out of nowhere. But interviews with a wide array of conservatives show that the confrontation that precipitated the crisis was the outgrowth of a long-running effort to undo the law, the Affordable Care Act, since its passage in 2010 — waged by a galaxy of conservative groups with more money, organized tactics and interconnections than is commonly known.

With polls showing Americans deeply divided over the law, conservatives believe that the public is behind them. Although the law’s opponents say that shutting down the government was not their objective, the activists anticipated that a shutdown could occur — and worked with members of the Tea Party caucus in Congress who were excited about drawing a red line against a law they despise.

A defunding “tool kit” created in early September included talking points for the question, “What happens when you shut down the government and you are blamed for it?” The suggested answer was the one House Republicans give today: “We are simply calling to fund the entire government except for the Affordable Care Act/Obamacare.”

The current budget brinkmanship is just the latest development in a well-financed, broad-based assault on the health law, Mr. Obama’s signature legislative initiative. Groups like Tea Party Patriots, Americans for Prosperity and FreedomWorks are all immersed in the fight, as is Club for Growth, a business-backed nonprofit organization. Some, like Generation Opportunity and Young Americans for Liberty, both aimed at young adults, are upstarts. Heritage Action is new, too, founded in 2010 to advance the policy prescriptions of its sister group, the Heritage Foundation.

The billionaire Koch brothers, Charles and David, have been deeply involved with financing the overall effort. A group linked to the Kochs, Freedom Partners Chamber of Commerce, disbursed more than $200 million last year to nonprofit organizations involved in the fight. Included was $5 million to Generation Opportunity, which created a buzz last month with an Internet advertisement showing a menacing Uncle Sam figure popping up between a woman’s legs during a gynecological exam.

The Kochs and Freedom Partners Chamber of Commerce want to mold the USA into something that resembles feudal lordships, with average American workers earning slave wages, powerless and without health care insurance. That is how they define freedom, a USA that looks like a few feudal lords having all the power, throwing the concept of government by and for the people in the trash.

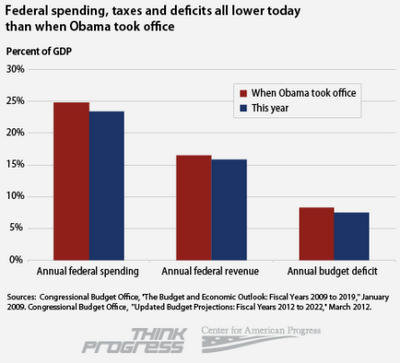

3. Conservative Republicans claim they are acting out of principles, that the deficit is out of hand. That is a baldfaced, shameless lie, Obama has done a remarkable job of getting the debts George Bush and conservatives ran up ( see chart at top) under control, False Equivalence That Leans on Public Opinion Is Still False Equivalence. Here's a fact: The deficit is falling. Here's another fact: Americans don't know the deficit is falling.