Conservative Republicans And The Perfection of Private Enterprise

Private systems are focused on making profits for a few well-positioned people. Public systems, when sufficiently supported by taxes, work for everyone in a generally equitable manner.

The following are six specific reasons why privatization simply doesn't work.

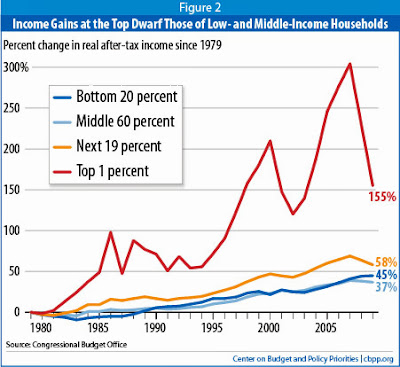

1. The Profit Motive Moves Most of the Money to the Top

The federal Medicare Administrator made $170,000 in 2010. The president of MD Anderson Cancer Center in Texas made over ten times as much in 2012. Stephen J. Hemsley, the CEO of United Health Group, made almost 300 times as much in one year, $48 million, most of it from company stock.

In part because of such inequities in compensation, our private health care system is the most expensive system in the developed world. The price of common surgeries is anywhere from three to ten times higher in the U.S. than in Great Britain, Canada, France, or Germany. Two of the documented examples: an $8,000 special stress test for which Medicare would have paid $554; and a $60,000 gall bladder operation, for which a private insurance company was willing to pay $2,000.

Medicare, on the other hand, which is largely without the profit motive and the competing sources of billing, is efficiently run, for all eligible Americans. According to the Council for Affordable Health Insurance and other sources, medical administrative costs are much higher for private insurance than for Medicare.

But the privatizers keep encroaching on the public sector. Our government reimburses the CEOs of private contractors at a rate approximately double what we pay the President. Overall, we pay the corporate bosses over $7 billion a year.

Many Americans don't realize that the privatization of Social Security and Medicare would transfer much of our money to yet another group of CEOs.

2. Privatization Serves People with Money, the Public Sector Serves Everyone

A good example is the U.S. Postal Service (USPS), which is legally required to serve every home in the country. Fedex and United Parcel Service (UPS) can't serve unprofitable locations. Yet the USPS is much cheaper for small packages. An online comparison revealed the following for the two-day shipment of a similarly-sized envelope to another state:

-- USPS 2-Day $5.68 (46 cents without the 2-day restriction)

-- FedEx 2-Day $19.28

-- UPS, 2 Day $24.09

USPS is so inexpensive, in fact, that Fedex actually uses the U.S. Post Office for about 30 percent of its ground shipments.

Another example is education. A recent ProPublica report found that in the past twenty years four-year state colleges have been serving a diminishing portion of the country's lowest-income students. At the K-12 level, cost-saving business strategies apply to the privatization of our children's education. Charter schools are less likely to accept students with disabilities. Charter teachers have fewer years of experience and a higher turnover rate. Non-teacher positions have insufficient retirement plans and health insurance, and much lower pay.

Finally, with regard to health care, 43 percent of sick Americans skipped doctor's visits and/or medication purchases in 2011 because of excessive costs. It's estimated that over 40,000 Americans die every year because they can't afford health insurance.

3. Privatization Turns Essential Human Needs into Products

Big business would like to privatize our water. A Citigroup economist exulted, "Water as an asset class will, in my view, become eventually the single most important physical-commodity based asset class, dwarfing oil, copper, agricultural commodities and precious metals."

They want our federal land. Attempts at privatization were made by the Reagan administration in the 1980s and the Republican-controlled Congress in the 1990s. In 2006, President Bush proposed auctioning off 300,000 acres of national forest in 41 states. Paul Ryan's Path to Prosperity was based in part on Republican Jason Chaffetz' "Disposal of Excess Federal Lands Act of 2011," which would unload millions of acres of land in America's west.

They want our cities. A privatization expert told the Detroit Free Press that the real money is in urban assets with a "revenue stream." So Detroit's most valuable resource, its Water & Sewerage Department (DWSD), is the collateral for a loan of $350 million to pay off the banks handling the litigation. Bloomberg estimates a cost of almost half a billion dollars, in a city where homeowners can barely afford the water services.

And they want our bodies. One-fifth of the human genome is privately owned through patents. Strains of influenza and hepatitis have been claimed by corporate and university labs, and because of this researchers can't use the patented life forms to perform cancer research.

4. Public Systems Promote a Strong Middle Class

Part of free-market mythology is that public employees and union workers are greedy takers, enjoying benefits that average private sector workers are denied. But the facts show that government and union workers are not overpaid. According to the Census Bureau, state and local government employees make up 14.5% of the U.S. workforce and receive 14.3% of the total compensation. Union members make up about 12% of the workforce, but their total pay amounts to just 10% of adjusted gross income as reported to the IRS.

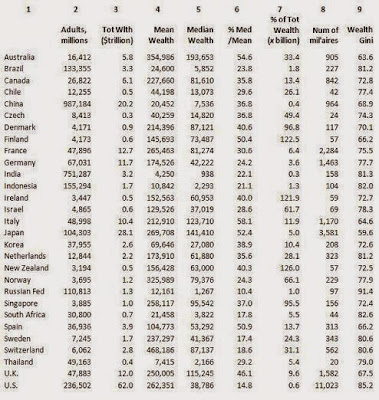

The average private sector worker makes about the same salary as a state or local government worker. But the median salary for U.S. workers, 83% of whom are in the private sector, was $18,000 less in 2009, at $26,261. Inequality is much more pervasive in the private sector.

5. The Private Sector Has Incentive To Fail, or No Incentive At All

The most obvious incentive to fail is in the private prison industry. One would think it a worthy goal to rehabilitate prisoners and gradually empty the jails. But business is too good. With each prisoner generating up to $40,000 a year in revenue, the number of prisoners in private facilities has increased from 1990 to 2009 by more than 1600%, from about 7,000 to over 125,000 inmates. Corrections Corporation of America recently offered to run the prison system in any state willing to guarantee that jails stay 90% full.

Nor do privatizers have incentive to maintain infrastructure. David Cay Johnston describes the deteriorating state of America's structural foundation, with grids and pipelines neglected by monopolistic industries that cut costs rather than provide maintenance. Meanwhile, they achieve profit margins of over 50%, eight times the corporate average.

As for public safety, warning signs about unregulated privatization are becoming clearer and more deadly. The Texas fertilizer plant, where 14 people were killed in an explosion and fire, was last inspected by the Occupational Safety and Health Administration (OSHA) over 25 years ago. The U.S. Forest Service, stunned by the Prescott, Arizona fire that killed 19, was forced by the sequester to cut 500 firefighters. The rail disaster in Lac-Megantic, Quebec followed deregulation of Canadian railways. At the other extreme is the public sector, and the Federal Emergency Management Agency (FEMA), which rescued hundreds of people after Hurricane Sandy while serving millions more with meals and water.

The lack of private incentive for human betterment is evident throughout the world. The World Hunger Education Service states that "Harmful economic systems are the principal cause of poverty and hunger." And according to Nicholas Stern, the chief economist for the World Bank, climate change is "the greatest market failure the world has seen."

6. With Public Systems, We Don't Have to Listen To "Individual Initiative" Rantings

Back in the Reagan years, a stunning claim was made by Margaret Thatcher: "There is no such thing as society. There are individual men and women, and there are families." More recently, Paul Ryan complained that government support "drains individual initiative and personal responsibility."

That's easy to say for people with good jobs.

Individual initiative? Our publicly supported communications infrastructure allows the richest 10% of Americans to manipulate their 80% share of the stock market. CEOs rely on roads and seaports and airports to ship their products, the FAA and TSA and Coast Guard and Department of Transportation to safeguard them, a nationwide energy grid to power their factories, and communications towers and satellites to conduct online business. Perhaps most important to business, even as it focuses on short-term profits, is the long-term basic research that is largely conducted with government money. As of 2009 universities were still receiving ten times more science & engineering funding from government than from industry.

Public beats private in almost every way. Only the hype of the free-market media keeps much of America believing that "winner-take-all" is preferable to working together as a community.

This work is licensed under a Creative Commons Attribution-Share Alike 3.0 License

Paul Buchheit is a college teacher, an active member of US Uncut Chicago, founder and developer of social justice and educational websites (UsAgainstGreed.org, PayUpNow.org, RappingHistory.org), and the editor and main author of "American Wars: Illusions and Realities" (Clarity Press).

Private enterprise is not an inherently bad system, but it relies on something terribly lacking in today's largely Conservative economy, moral responsibility. That's right. Our systems would work better and keep more money in the pockets of people who do actual work and have real ideas if our economy was not structured in a way that redistributes the capital created by workers to filthy rich CEOs and Wall Street gamblers. That used to be the grand bargain - OK you corporate cronies can make a lot of money, but in return you cannot take advantage of or steal from workers. The elite top 10% have taken a butcher knife to that bargain and made over half of America into wage slaves - who no matter how hard they work will never get ahead - a good recent example. .